Money, often regarded as a mere tool of exchange, holds an unparalleled influence over human behavior, decisions, and emotions. Its power extends far beyond its primary function as a medium for buying and selling; it plays a profound role in shaping our psychology, from our self-worth to our relationships with others.

The Emotional Spectrum of Finance

At the core of every financial decision lies a blend of rational and emotional drivers. On one end, people see {money} as a means of security. Amassing wealth can provide a cushion against unforeseen events, giving people peace of mind. On the opposite end, money often becomes a symbol of success, driving individuals to equate their net worth with self-worth. This can lead to a relentless pursuit of material wealth, sometimes at the cost of personal well-being.

Money and Social Dynamics

Humans are innately social beings, and our financial decisions often reflect our position in society. Possession of {money} or the lack thereof can influence our social interactions. Affluence can lead to a heightened sense of pride or arrogance, while financial struggles can lead to feelings of inferiority or shame.

Moreover, societal norms and expectations play a pivotal role. We often spend not just for our needs but also to project a certain image. Whether it’s buying a high-end car or living in a posh locality, many are propelled by the desire to “fit in” or even “stand out”.

Decision-making: More Than Just Logic

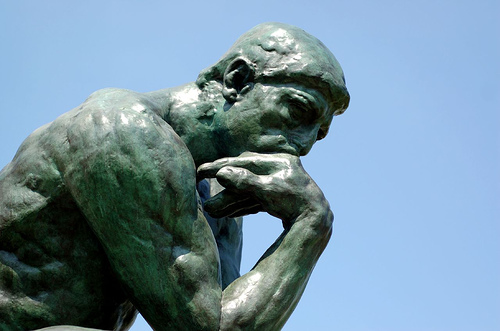

The decision to spend, save, or invest {money} isn’t always a logical one. Behavioral economists have long observed that humans often act against their best financial interests. For example, the thrill of a short-term gain might prompt an individual to make a hasty investment, overlooking long-term risks. Similarly, the immediate pleasure of purchasing a luxury item might outweigh the future benefits of saving that amount.

Financial Education and Mindset

One might assume that better financial knowledge directly correlates with better money management. However, even the most educated sometimes fall prey to their psychological biases. That said, understanding the basics of finance can certainly help one recognize these biases and potentially mitigate their effects.

Conclusion

Money’s influence on our behavior and decisions is undeniable. By understanding the deep-seated psychological connections and societal pressures surrounding {money}, individuals can aim for more informed, rational, and healthy financial choices. It’s not just about earning and spending; it’s about cultivating a balanced relationship with money for a fulfilled life.